Generative AI and AWS: How We Automated Risk Management for Pirani

About the Client

Pirani is a specialized software platform for risk management. It offers a comprehensive solution covering the identification, measurement, control, and monitoring of risks, tailored to comply with both local and international regulations. With its user-friendly approach and innovative features, Pirani has earned recognitions such as those from G2, solidifying its position as an industry leader.

What was the challenge Pirani solved with Pragma's support?

While Pirani already facilitated the management of operational risks, users often struggled to identify and define specific risks within their organizations. This not only affected the quality of their risk management processes but also increased the operational workload on Pirani’s advisors, as many clients relied heavily on constant consultative support.

Pirani aimed to create a tool that would automate the risk identification process using accurate data, optimize operational efficiency, ensure regulatory compliance, and prevent the misallocation of resources.

Outcome: Our impact

accuracy in the model powered by Amazon Bedrock.

reduction in operational workload.

availability of virtual consultations.

The generative AI transformed the tool, enabling users to independently manage risks without relying on external consultants. This breakthrough reduced manual processes by 60% while improving the speed and efficiency of risk management, leading to increased user satisfaction.

Automation freed up resources for strategic tasks, significantly enhancing operational efficiency. With Pragma’s solution, Pirani established itself as a cutting-edge platform for risk management, standing out among competitors.

How we did it?

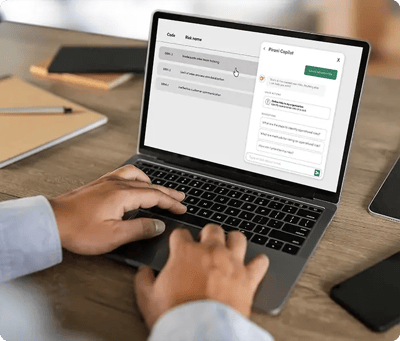

Pragma addressed the challenge by implementing a Generative AI-based solution using AWS. At its core was Amazon Bedrock, which enabled the development of an intelligent generative AI agent capable of responding to user queries in natural language. This virtual agent also interacted with users to detect organizational risks and produce a prioritized list for streamlined management.

The AI agent was integrated with a knowledge base containing updated information on policies, frameworks, user data, and foundational Generative AI models. This integration allowed users to identify and manage risks with speed, accuracy, and confidence.

To ensure scalability and efficiency, the solution leveraged services such as:

- AWS EKS for managing Pirani’s microservices, ensuring high availability and optimal performance.

- AWS Lambda, which handled the interaction logic between the Bedrock agent and users, encapsulated this logic, and exposed it via an API to optimize risk creation processes.

- AWS API Gateway to enable secure communication between the frontend and microservices.

- AWS CloudFront and AWS WAF, which provided a secure platform for the web portal, protecting it from common threats while ensuring fast access for users.

- AWS S3 to store both structured and unstructured data feeding the agent’s knowledge base.

- AWS Aurora for a scalable, high-performance database to manage large volumes of information.

- AWS Cognito for secure user authentication, integrated with API Gateway to ensure proper access control.

- AWS IAM, which defined roles and policies to maintain a secure infrastructure.

Together, these services enabled Pirani to offer a comprehensive and efficient risk management solution, automating key processes and significantly enhancing the user experience.

Ready to Build Generative AI Solutions That Drive Tangible Business Impact?

Related success stories

We strengthen the culture of agility in one of the biggest banks in Latam

We drove Bancolombia's digital transformation, reshaping the way they work and obtaining better results in their innovative initiatives.

We developed a 100% digital with more than 12 million users

We helped Nequi reach the category of Best Digital Banking worldwide by changing how banks relate to users.

Keep moving. Let's talk.