Custom Software Systems & Digital Banking Solutions for Credit Unions

Legacy systems slow you down. Manual work drains your team. And today’s members expect more, faster.

At Pragma, we partner with credit unions to accelerate change. We streamline operations, reduce costs, and deliver seamless, digital experiences your members deserve, all through customized innovation built for your reality.

Mortgage Origination Built for Credit Unions

We’re helping credit unions modernize their mortgage experience with MOSS, a modular Mortgage Origination Software Solution. MOSS empowers your team to deliver faster, more transparent home financing while giving members the intuitive, digital-first journey they expect.

- Self-service portals and real-time updates for members and brokers

- Streamlined workflows that reduce manual effort and improve file quality Seamless integration with your LOS, core systems, and compliance tools Built for rapid deployment — no heavy lift from internal IT teams

Aging Membership

Credit unions’ average member age is 53 vs. U.S. median of 39, pushing urgent shifts in youth engagement strategies.

Manual Bottlenecks

Credit unions lose 20–30% of revenue to inefficiencies, with over 40% of tasks ripe for automation.

Operational Drag

67% of credit unions cite outdated systems as barriers to efficiency, driving demand for core modernization.

Proven at Scale. Check our Success Stories!

US Mortgage Lender cut Cloud provisioning cycle from 3 weeks to 3 days; borrowers now receive funds in ~3 days.

.png?width=1298&height=200&name=3NP%20Logo%20Black%20(1).png)

.png?width=187&height=58&name=nequi-colombia-logo-CF8C45C51E-seeklogo.com%201%20(1).png)

Custom Credit Union & Loan Solutions

Digital Mortgage Origination Experiences

We build seamless, user-friendly mobile and web apps that enhance every step of the member journey.

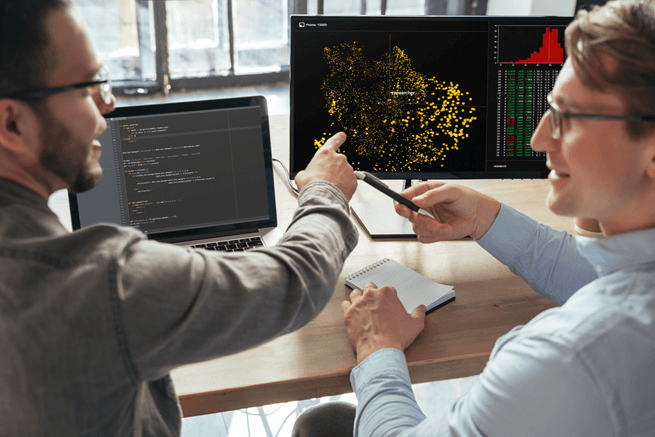

AI‑Ready Underwriting Workflows

Our AI solutions automate processes and deliver personalized member experiences to boost efficiency and engagement.

Omnichannel Borrower Journey

We enable smooth transitions across physical and digital channels using Flutter front-ends and scalable APIs.

Core & LOS Integrations

Hands‑on integration services for Fiserv, FIS, Jack Henry, Encompass®, ICE Mortgage Technology, and more.

Compliance & Security Engineering

ISO 27001 & ISO 9001‑certified development practices with automated audit trails and document retention.

Modern Architecture Patterns

Microservices, event streaming, and Kubernetes deployments that scale on AWS, Google Cloud, or on‑prem.

Why Choose Pragma

Financial DNA

Almost three decades of experience working with financial services companies.

Outcome‑Based Engagements

Clear success KPIs and shared accountability.

Real‑Time Collaboration

Nearshore pods aligned to U.S. time zones.

Enterprise‑Grade Partnerships

AWS, Google Cloud, Salesforce, Datadog, and other.

Speed to Value

Production‑ready increments every two weeks; 95 % of projects hit MVP within 120 days.

What is Credit Union and Loans Solutions Outsourcing?

Pragma’s nearshore outsourcing model provides expert teams to develop core banking integrations, digital member services, AI-driven lending solutions, and cybersecurity frameworks tailored for credit unions.

Powering Mortgage Solutions with Top tech Partners

-1.png?width=118&height=60&name=Accenture-aws-logo%20(2)-1.png)

-1.png?width=199&height=100&name=Accenture-microsoft-logo%20(2)-1.png)

.png?width=139&height=70&name=Accenture-google-logo%20(2).png)

Our outcome-driven approach through

the eyes of our clientes

Newsroom

Predictive Analytics: The key to Hyper-Personalization in banking

Flutter in Banks and Fintech Companies: The Key to Omnichannel Experiences