Custom Mortgage Software & Lending Systems Development

In a constantly evolving real estate market, mortgage and loans need to be digital! At Pragma, we provide strategic software engineering to empower US banks, credit unions, and lenders to win modern borrowers.

Scalable Mortgage Lending Software & Programs

We’re helping independent lenders accelerate growth and streamline operations with MOSS, a modular Mortgage Origination Software Solution. Designed for high-volume, high-urgency environments, MOSS gives you the tools to close faster, operate leaner, and scale without the typical tech burden.

- Fast, borrower-friendly portals and real-time loan tracking

- Role-based tools for loan officers, processors, and brokers

- Built-in integrations with LOS, pricing engines, credit, and disclosures

Digital lending: Your next growth engine

Shift in Borrower Behavior

65 % of U.S. mortgages began online in 2024, and digital‑first borrowers now expect the same‑day

Margin Compression

Fintech entrants operate at 35‑40 % lower cost‑per‑loan, forcing traditional lenders to re‑platform.

Regulatory Pressure

TRID, Fair Lending, and ESG disclosures demand auditable, data‑driven workflows.

Proven at Scale. Check our Success Stories!

U.S. Mortgage Lender cut Cloud provisioning cycle from 3 weeks to 3 days; borrowers now receive funds in ~3 days.

.png?width=500&height=77&name=3NP%20Logo%20Black%20(1).png)

.png?width=187&height=58&name=nequi-colombia-logo-CF8C45C51E-seeklogo.com%201%20(1).png)

Custom Mortgage & Loan Solutions

Digital Mortgage Origination Experiences

We design and build borrower portals and mobile apps that capture and validate data in minutes.

AI‑Ready Underwriting Workflows

We integrate data and analytics pipelines to enable instant pre‑qualification and personalized offers.

Omnichannel Borrower Journey

Seamless hand‑offs between branch, call‑center, and self‑service channels, built with Flutter front‑ends and scalable APIs.

Core & LOS Integrations

Hands‑on integration services for Fiserv, FIS, Jack Henry, Encompass®, ICE Mortgage Technology, and more.

Compliance & Security Engineering

ISO 27001 & ISO 9001‑certified development practices with automated audit trails and document retention.

Modern Architecture Patterns

Microservices, event streaming, and Kubernetes deployments that scale on AWS, Google Cloud, or on‑prem.

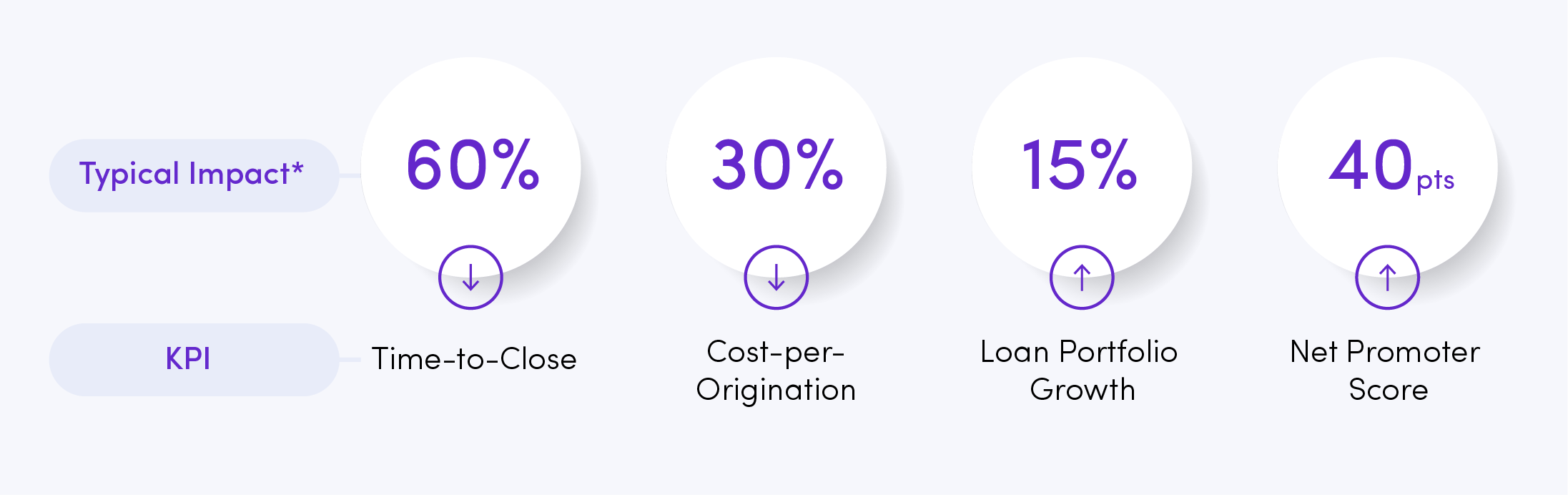

Tangible Business Impact

*Based on recent Pragma engagements.

Why Choose Pragma

Financial DNA

Almost three decades of experience working with financial services companies.

Outcome‑Based Engagements

Clear success KPIs and shared accountability.

Real‑Time Collaboration

Nearshore pods aligned to U.S. time zones.

Enterprise‑Grade Partnerships

AWS, Google Cloud, Salesforce, Datadog, and other

Speed to Value

Production‑ready increments every two weeks; 95 % of projects hit MVP within 120 days.

What is Mortgage and Loans Solutions Outsourcing?

Pragma provides specialized nearshore teams to build digital mortgage platforms, and automated loan origination systems, streamlining processes and reducing operational costs.

Powering Mortgage Solutions with Top tech Partners

-1.png?width=118&height=60&name=Accenture-aws-logo%20(2)-1.png)

-1.png?width=169&height=85&name=Accenture-microsoft-logo%20(2)-1.png)

.png?width=119&height=60&name=Accenture-google-logo%20(2).png)

Our outcome-driven approach through

the eyes of our clientes

Newsroom

Predictive Analytics: The key to Hyper-Personalization in banking

Flutter in Banks and Fintech Companies: The Key to Omnichannel Experiences